|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring the Lowest VA Home Loan Refinance Rates in Today's MarketUnderstanding the nuances of VA home loan refinance rates can significantly impact your financial decisions. In this article, we delve into the factors affecting these rates and how you can secure the lowest rates available. Factors Influencing VA Home Loan Refinance RatesCredit ScoreYour credit score plays a pivotal role in determining the interest rate you'll receive. A higher credit score can lead to a lower interest rate, potentially saving you thousands over the life of your loan. Loan Amount and TermThe size and duration of your loan also influence the rates. Generally, shorter-term loans have lower rates compared to longer-term loans. Strategies for Securing the Lowest Rates

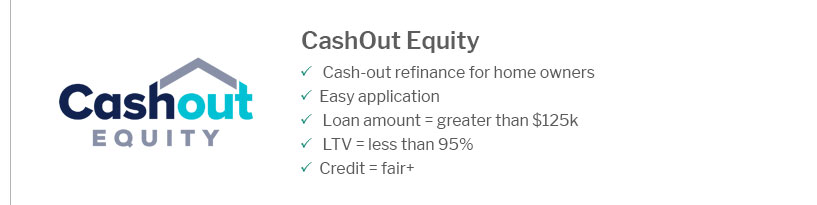

For those interested in exploring other refinancing options, a cash out refinance loan for home can also be a viable alternative. Real-World ExamplesConsider John, a veteran, who was able to reduce his interest rate by refinancing his VA loan. By improving his credit score and shortening his loan term, John saved approximately $15,000 over the loan's life. Frequently Asked QuestionsWhat is the average VA refinance rate?The average VA refinance rate fluctuates based on market conditions but typically ranges from 2.5% to 3.5%. How can I improve my VA refinance rate?Improving your credit score, opting for a shorter loan term, and shopping around for the best offers can help lower your rate. Are there alternatives to VA loan refinancing?Yes, options like a cash out refinance on FHA loan may be suitable for those who qualify. Securing the lowest VA home loan refinance rates requires diligence and knowledge. By understanding the influencing factors and implementing strategic measures, veterans can optimize their financial outcomes effectively. https://www.calvet.ca.gov/HomeLoans/Pages/Current-Interest-Rates.aspx

Interest rates as low as 5.125%*. Page Content. 5.427% APR*. https://griffinfunding.com/traditional-mortgages/va-loans/va-rates/

However, one thing to make clear is that the Department of Veteran Affairs does not set VA home loan rates. Rather, individual lenders determine VA home loan ... https://lowvarates.com/va-loans/va-interest-rates/

If you want to know how to get a VA Home Loan with low-interest rates, then a general rule of thumb is to find VA interest rates that are about .25% - .375% ...

|

|---|